Client Background

The client importantly operates the financial institutes in different countries. It values no other lender can - a deep understanding of your industry, unmatched equipment expertise, and personalized financial solutions that can be quickly arranged through your dealer at the time of our purchase.

Objective

The client was looking for a digital solution that efficiently handles their financial activities and day to day tasks. They came to us with the idea to build Employee Collaboration & Document Management (ECDM) system.

-

Country

South Africa -

Industry

Financial Services -

Solution

Data Engineering & Analytics, Power BI,

Microsoft Azure

Challenges

Before coming to us for a digital solution for their organization, the client was used to handling all business-related procedures manually, and they quickly discovered that the manual activities were adding to their workload and negatively impacting their bottom line. The following are some of the client's key issues during that time period:

- The client struggled to provide their employees with insights into both individual and company performance

- It was a challenge for the client to organized data in a better manner

- The client was unable to make the appropriate business decision due to the lack of a financial analysis system

- It was difficult for the client to manage various customer accounts simultaneously

- The more manual interventions resulted in unreliable reports

- The client was found it difficult to calculate the interest on the basis of daily products

Contact us.

Solution

After examining the requirement of the client, KCS’s developers have provided the following solution to him/her:

- It's become easy for the client now to calculate the interest on the basis of daily products

- Due to most of the automated activities, the client is able to handle the account of different customers simultaneously

- Efficient document management & tracking of the status across the organization

- With the help of this solution, a client is capable of organizing the data in a meaningful manner

- Because of the automated solution, a client now obtains realistic reports, allowing them to make sound business decisions

Project Highlights

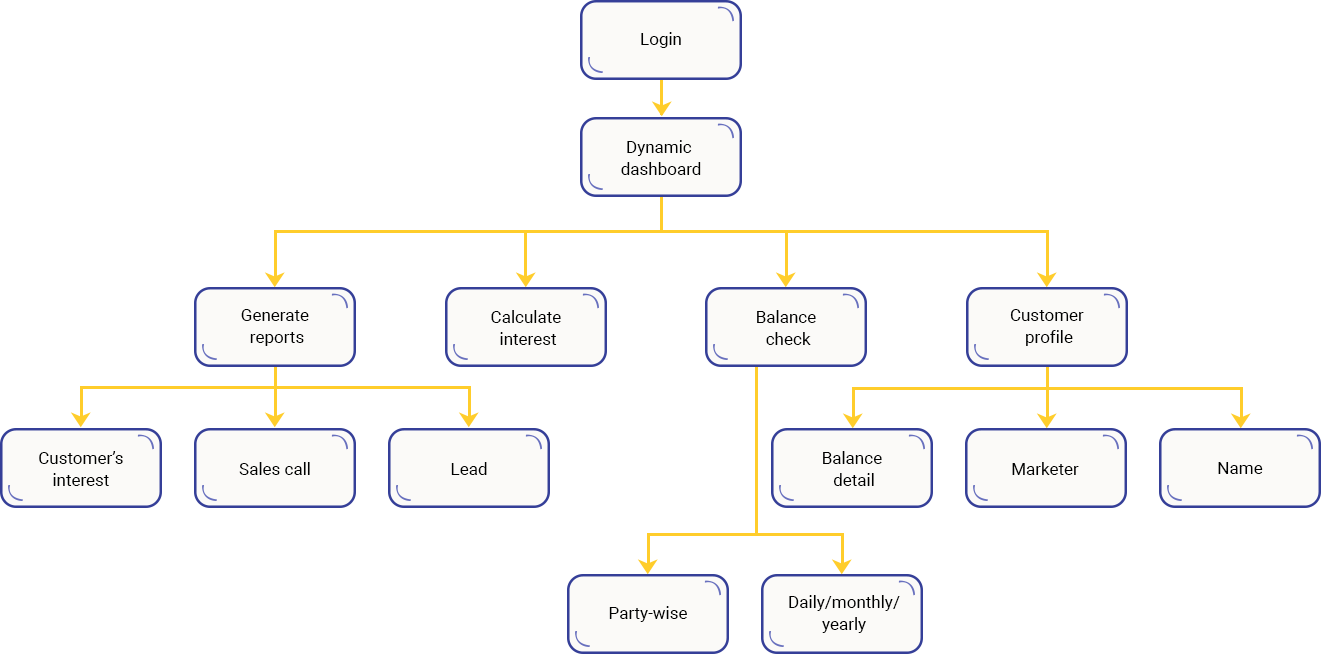

Dynamic Dashboard: Customer / Marketer Details

Data Analysis

TAT Analysis

Graphical Reports

Daily / Weekly / Monthly Reports

Pie Chart Representations

Finance Management Funnel

KCS Approach

KCS developers aim was to develop a solution that automates the entire process of lending money. Moreover, the intelligent solution helps the client experience lightning speed while eliminating manual errors for better productivity and profitability.

Outcome

Our intelligent ECDM and Power BI solution helped the client conduct better business analytics. It benefited the client with better management of data, increased transparency, and enhanced service delivery improving customer experience. Data Analytics helped the client develop new strategies. The client was able to get a single-holistic view of performance across all the segments.

It also simplifies various operations due to a higher level of automation. Moreover, extensive and in-depth reporting resulted in a better-decision making process. The client was able to gain useful information on the basis of smart reports.

Tech Stack